From gold to copper to silver to palladium, precious metals, sometimes mistakenly considered Old School by millennials who prefer Bitcoin to good old yellow metal, still resist well to the wrinkles of age and continue to be a safe haven in times as uncertain as the ones we are going through.

But what are we really talking about when we talk about a precious metal? What is its true value over time? And why invest in these assets for the little original today?

We'll take you on a tour with us of the precious metals in which to invest in 2020, and you'll even see that combining cryptomony and precious metal is now possible... we won't tell you more!

Precious metals, kezako?

Osmium, iridium, rhodium, ruthenium, this list tells you nothing? Yet they are all precious metals, appreciated in the same way as gold, silver, copper or palladium for their high economic value. These elemental metals, since they are originally extracted from the ground, although increasingly recycled today, are moreover often used as currency and from this angle you know them best as well as in jewelry.

In other cases, the metal is considered precious because it is appreciated by other uses that make it a rare asset. The best known of them are of course the precious metals resistant to corrosion, that is to say the alteration of the metal by a chemical reaction with the oxide (for those who did not make Bac S like me, Jamy in C'est pas Sorcier has already had to explain it). These so precious metals are thus used in investments, money and of course jewelry, probably the form in which they are most recognizable in the eyes of the general public.

Historically, and we already told you about it in a previous article, precious metals were a currency and in Roman and Croesus times, gold and silver were the two metals most used to make money.

It is moreover from this time that the famous quote came from: "to be rich like Croesus".

Let's go back in time: at that time, around 596 BC, the kingdom of Croesus was located in what is now Turkey, and a river full of gold flowed through it, called The Pactole. During antiquity, the gold sands of the Pactole allowed the work and trade of gold in very large quantities, you can imagine the "miners" of the time and their "pactole".

The legend even tells that Croesus would have made offerings to the Greek temples, Artemis and Ephesus in particular. And one finds in these offerings, the modest sum of pure gold bricks, silver barrels, or a statue entirely made of gold.

In short, we return in 2020 and precious metals are still popular!

Why are they so precious?

Precious metals were originally extracted directly from the ground and are now an important business of various gold companies. We talk about precious metal because of its rarity, but logically, the more discoveries are made, the lower the price.

Let us recall the episodes of the gold rush on the west coast of the United States, the industrial revolution and all the technologies that allowed the modernization of the production lines, today these companies are running at full speed with rethought processes. However, like Bitcoin, which does not exist in unlimited quantities, gold is becoming increasingly scarce, which partly explains its attractiveness and its value as a reserve and refuge.

Consider the hundreds of uses that our companies make of precious metals: without them you would have no smartphones, photovoltaic panels or electronic components, these precious metals have become the alpha and omega of new technologies and renewable energies. Since the 1970s, the consumption of metals has been exponential, so there has been a massification of extractions and an explosion of energy consumption linked to the greenhouse gases produced by the gold activity. Faced with the multiplication of new technologies that consume more and more precious metals, alternatives are being studied in an attempt to reduce this ecological risk.

Firstly, more and more players are turning to the recycling and reuse of precious metals, thus avoiding extraction directly from the earth's crust and pollution of the water tables by the metal purification and refining process. The recycling of gold, for example, has existed for decades, even though today in France only 20% of recycled gold is reused.

Even more recently, France Stratégie has initiated a reflection to study the possibility of imposing a carbon tax on metals, to optimize its use and encourage recycling. All in all, if these metals remain precious, many researchers are trying to explore the field of possibilities to continue finding gold and precious metals.

Moreover, from January 2021, Swiss gold refiners will have to indicate whether the imported gold comes from mining, banking or recycling. A further step towards transparency and responsibility. I'm told in the earpiece that a blockbuster project to make transparent and propel refiners into a new era could be a good idea!

But if precious metals are becoming scarcer on Earth, let's aim higher!

Precious metals and the universe: the new deal?

A mystery still hangs over our scientific friends: why is there gold in bar (abundance) in the universe? While the stock of gold underground is decreasing noticeably from year to year, many astronomical experiments have revealed the mass presence of gold in the universe.

A recent report published in The Astrophysical Journal thus reveals that the main source of gold present in the universe today, namely collisions between stars and neutrons, would not be sufficient to explain the golden abundance hovering above us. The mystery persists!

Moreover, this leads me to take a quick look back at: how did it rain gold on Earth?

This goes back to the time when planet Earth was still in formation: many meteorites that contained gold ended up crashing to earth due to collisions, and here are our first gold reserves, a real treasure hunt that men will later engage in in search of the precious yellow metal.

But this is not enough to explain the current abundance, so you know the scientists they have made tons of calculations to come up with this theory:

"According to our model, the mass of gold produced in the Universe during its 13.8 billion years is 4 x 10^42 kg, which is only 10 to 20% of what is expected from observations in meteorites, the Sun and other nearby stars". Chiaki Kobayashi, astronomer from the University of Hertfordshire

And we also know that there would be "only" 50,000 tons of gold left under our soil today, enough to leave a little margin for earthly exploration before attacking the race to the stars.

The Top 10 precious metals in circulation today in which to invest

If gold has made its mark this summer by crossing the symbolic $2,000 per ounce mark, many precious metals have definite advantages in investing some of your peculiarities in a safe value. Among all the metals present on this earth, we deliver you the top 10 precious metals:

1- Gold, a precious metal prized on the markets

Durable, malleable, desired, so many qualifiers that have made the reputation of yellow metal for centuries. In fact, it is one of the assets that performed best during the Covid-19 crisis. Constituting one of the most popular investment options, it is present en masse in South Africa, Australia, China and the United States and is mainly used in the jewellery and industrial sectors.

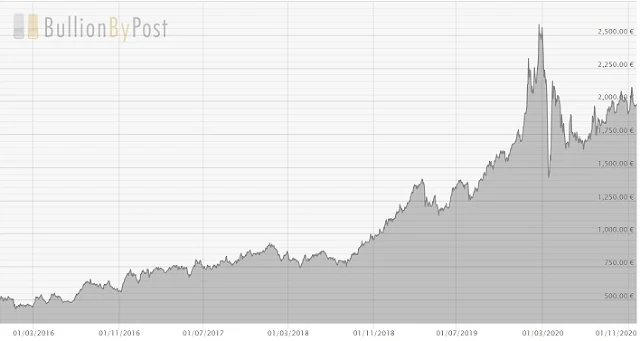

Benefiting from interesting returns this year, its price has only increased over the last 5 years:

2- Silver, one of the densest metals

With the highest electrical and thermal conductivity and the lowest contact resistance, its value does not sag. Used in turbine engines, but also in electronics, dentistry, jewelry and photography, it is mainly found in Chile, Kazakhstan and the United States. It has also benefited from an improvement in its price over the last 5 years, even if it still has a lot to prove to us, since it can be bought today for around 20€:

3- Platinum, undoubtedly the most precious of the precious metals

Very malleable, dense and with serious non-corrosive properties, this metal is resistant to a large amount of hydrogen. It is found in armament, aeronautics, jewelry and its production is concentrated in South Africa, Russia and Canada. Combining rarity and functionality, it would be the most precious of the precious ones:

4- Palladium, the false twin of platinum

Almost comparable to platinum, this very rare metal, prized by the automotive industry, in particular, who use it for their catalytic converters to reduce emissions, or by jewelers to create the famous "white gold", is mainly found in the same countries as its false twin. In terms of performance, its price has only risen since the beginning of 2020 due to a market deficit horizon for many economic reasons. It has nevertheless exceeded €2500 at the beginning of 2020.

As for the other precious metals less in the spotlight, we find :

5- Ruthenium, which is part of the platinum group

6- Rhodium, a very rare and very reflective material found in our mirrors, for example

7- Iridium, one of the densest and most resistant metals

8- Osmium, an extremely robust bluish metal

9- Rhenium, one of the densest metals with the third highest melting point

10- Indium, a rare metal produced from the processing of zinc ore, as well as lead, iron and copper ores.

As for copper, which is generally cited in the list, it would be wrong to consider it as precious because of its characteristics, particularly oxidizable, but it can be listed as a precious metal because of its use as currency.

Investing in precious metals represents an interesting diversification and profitability in the long term, especially in times of strong market turbulence. And even if no investment is safe, as you will be told time and again, precious metals have proven over time to be safe and solid in the face of the upheavals of our world. The central issue being the security of their storage, and we will tell you about it right away by focusing on one of the major projects of the sector today that combines the best of both worlds: yellow gold and digital gold.

Focus on tokenized gold, the must have precious metals to have in your portfolio

Now that you are an ace of precious metals, I could not conclude this article without telling you about a crazy project that Jean-François Faure decided to mount. He had already tried his hand at it with Aucoffre.com, Veravalor, Veracash, and then the latest addition to the tribe : VeraOne.

The principle is simple, he created a stable token directly backed by physical gold, held by you in your wallet and secured in Switzerland to protect your precious.

After spending more than 10 years on the gold market, our adventurer was not at his first try and he thought of everything :

- The gold extracted from the VRO token corresponds to the LBMA (London Bullion Market Association) label and thus ensures that the gold is mined with respect for human rights.

- 90% of the gold comes from recycled gold at VeraOne, and it is committed to continue to increase this figure so that it is no longer dependent on the gold activities.

- VRO in addition to containing gold is also a crypto currency and you know as well as I do that this is the future of the economy! It is therefore transferable in a few seconds wherever you want.

- It allows you to counter the volatility in investment in a modern way in the oldest safe haven in the world.

There is no need to say, this project is a nugget of the sector and allows us to see life in gold!