The U.S. Federal Reserve is expected to raise the federal funds rate during its next meeting on Wednesday and JPMorgan economist Michael Feroli believes that rising inflation will push the Fed to increase the rate by 75 basis points (bps). Last week, CME Group data indicated the market priced in a 95% chance that the U.S. will see a 50 bps rate hike this month. Although, while some expect a hawkish Fed, some believe the U.S. central bank may act dovishly if markets get worse.

Global Markets Shudder With Focus Directed at the Fed’s Next Rate Hike — JPMorgan Economist Expects a 75 bps Increase

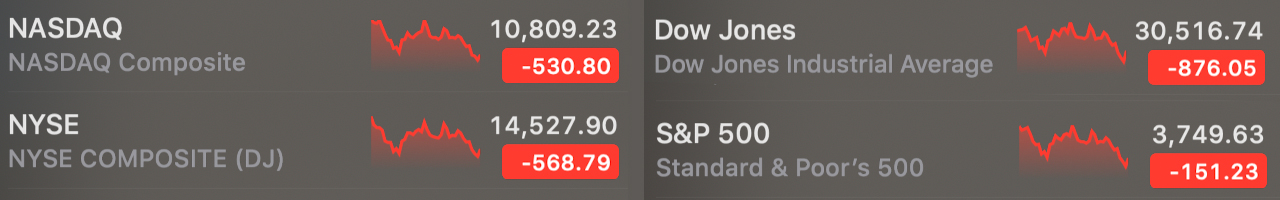

Major U.S. stock indexes and cryptocurrency markets dropped significantly on Monday, as the day was considered one of the bloodiest starts to the week in a long time. CNBC’s Scott Schnipper said on Monday that the “S&P 500 is now in an official bear market, according to S&P Dow Jones Indices.”

Precious metals like gold and silver dropped in value as well, as gold’s price per ounce slipped 2.67% and silver dropped 3.58%. The entire crypto economy lost 18% during the course of the day on Monday and BTC dropped below $21K. Currently, all eyes are on the upcoming Federal Open Market Committee (FOMC) meeting where members of the Federal Reserve System are expected to raise the federal funds rate.

Moderate increases can be between 25 to 50 bps. The Fed can go as high as 75 to 100 bps during the next meeting and some are predicting 75 basis points is in the cards. Last week, CME Group data had shown the market priced in a 95% chance that the Fed would raise the benchmark rate by 50 bps. However, JPMorgan economist Michael Feroli thinks a 75 bps increase is coming and 100 bps is also possible.

Feroli told clients in a note on Monday that a “startling rise in longer-term inflation expectations” may push the Fed to increase the rate by 75 basis points on Wednesday. “One might wonder whether the true surprise would actually be hiking 100bp, something we think is a non-trivial risk,” Feroli added.

Goldman Sachs Economists Predict a 75 bps Hike — JPMorgan Strategist Marko Kolanovic Thinks a Dovish Surprise Could Happen

Goldman Sachs economists agree with Feroli as they believe a 75 bps hike will likely be announced at the FOMC meeting. “Our Fed forecast is being revised to include 75 bps hikes in June and July,” Goldman economists explained on Monday.

The Goldman Sachs analysts’ note to investors adds:

We anticipate two more rate increases in 2023 to 3.75-4%, followed by one cut in 2024 to 3.5-3.75%. We anticipate a 50bp increase in September, followed by 25bp increases in November and December, for an unchanged terminal rate of 3.25-3.5%. We expect the median dot to show 3.25-3.5% at end-2022.

Meanwhile, despite Feroli’s 75 bps prediction, JPMorgan’s Marko Kolanovic told the press that the U.S. will likely avoid a recession. The strategist at JPMorgan Chase & Co. explained that Fed may act dovish going forward due to the craziness in bond markets and stock markets as well.

“Friday’s strong CPI print that led to a surge in yields, along with the sell-off in crypto over the weekend, are weighing on investor sentiment and driving the market lower,” Kolanovic’s note to clients detailed on Monday. “However, we believe rates market repricing went too far and the Fed will surprise dovishly relative to what is now priced into the curve,” the JPMorgan strategist added.

What do you think about the upcoming FOMC meeting and the next rate hike? Do you think it will be moderate or aggressive? Or do you think a dovish surprise is in the cards? Let us know what you think about this subject in the comments section below.

Post a Comment