UFO of the financial world, bitcoin presents itself as an alternative means of payment over which States have no control. Find out how it works.

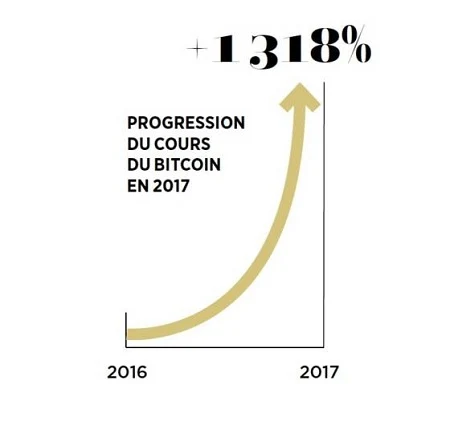

What strikes you when you hear about bitcoin is the crazy progression of its price in 2017: + 1.318%! Obviously, it makes you want to sell out your livret A and take the highway of speculation in the hope of becoming Croesus in a handful of weeks. But, beyond its speculative aspect, what is this new currency really for? This is often where things get tough ... Bitcoin is a virtual currency whose sole function is to make online payments, without an intermediary. No more no less. Its incredible growth tends to obscure this fundamental aspect.

Bitcoin has no physical existence and is not dependent on any central bank. It cannot be turned off: its system is based on a network, the “blockchain”, powered by tens of thousands of computers across the planet. It should be seen as a giant account book, reputed to be tamper-proof, in which the history of all transactions is listed. Little is known about the creator of bitcoin, the very mysterious Satoshi Nakamoto. Its existence boils down to a few traces on the Internet. There are no photos of him and it is very likely that his name is a pseudonym.

BORN AFTER THE FINANCIAL CRISIS

Most of its work was done in late 2008, as the financial crisis loomed. Many specialists consider his project as a way of freeing oneself from banks and States, whose responsibility was then called into question. But Satoshi Nakamoto has never confirmed these claims. Evoking in his writings the origin of bitcoin, he is content to point out the technical shortcomings of the time. Its ambition is therefore to develop a more efficient alternative system. The mathematician starts from the postulate that we are forced, to guarantee our transactions, to have recourse to financial institutions. This situation generates, according to him, too high costs and the acceptance of a certain amount of fraud. “What we need, writes Nakamoto, it is an electronic payment system based on cryptographic evidence, which would allow two parties who so wish to carry out transactions directly between them without having recourse to a trusted third party. ” Thus was born bitcoin.

The trust that Nakamoto holds so dear is guaranteed by the “minors”. The term refers to people who leverage the computing power of their overpowered computers to validate transactions (photo below). It is this “proof of work” that makes the blockchain tamper-proof. Hacking it would require providing more than half the power of all miners. It is difficult to assess the cost of such an operation, but it is hard to imagine an individual spending a gigantic fortune to hack a system that would collapse in a second ... and from which he could no longer benefit.

The protocol is designed not to exceed the threshold of 21 million units in circulation (compared to the 15 billion euro banknotes in circulation, for example). It's a little and a lot at the same time (a bitcoin can be split up to 100 million times). Miners also take care of money creation: a complex mathematical equation is submitted to them every ten minutes, and the fastest machine receives a reward in bitcoins. Divided by two every four years, it is currently 12.5 bitcoins and the last unit will be produced around 2140. The miners are finally remunerated with transaction fees, the amount of which varies according to the congestion of the network (from a few cents to several tens of euros).

NUMBERS AND LETTERS

According to its supporters, the bitcoin protocolgives this cryptocurrency a digital gold status: by freeing itself from the monetary creation of States, it can be assimilated to a safe haven. In March 2013, for example, many Cypriot bank customers converted their holdings into bitcoins… just before the introduction of strict exchange controls. However, do not invest your savings thinking that you are protecting them! Not being subject to any regulation, bitcoin generates strong speculation. Phenomenal increases are regularly followed by double-digit drops. In December 2017 alone, the price rose from 8,500 euros to more than 16,000 euros in the first fortnight. Very badly took the neo-investors attracted by this record: the price fell by 40% a few days later and for no objective reason!

Alright, you will say. But how does being the owner of bitcoins represent? Quite simply by a series of numbers and letters which constitutes a virtual key. It is unique and should never be communicated. Anyone who owns it can use it and spend your bitcoins. It should therefore be stored in a safe place away from data theft. When you make a transaction on the network, it generates another key, more rudimentary, which will act as your signature on the blockchain. Contrary to popular belief, bitcoin is not anonymous: all transactions are freely available on the network and a specialist can quickly identify you if you have been active. By clicking on your key, you can find all kinds of interesting information: the amount of your transactions, recipients of funds, etc. We will therefore not say that bitcoin is anonymous, but “pseudonym”.

FOR A FEW BITCOINS MORE

Are all these characteristics likely to change over time? Yes, it is a possibility. Bitcoin is designed as open source, that is to say that anyone can, at any time, propose a modification. We can therefore imagine that there will one day be more than 21 million bitcoins in circulation or that it be assigned other functions than simple payment (adding conditions to it, for example). But cryptocurrency is developed by a heterogeneous community bringing together computer scientists, large companies in the sector and users. For changes to be validated, they must be accepted by the majority of network participants. And, in the end, everyone remains free to adopt the changes by updating their software. Or not…

Thus, twice since the launch of bitcoin, a minority part of the community has chosen to create a competing branch: bitcoin cash (August 2017) and bitcoin gold (October 2017) were born from these differences. These schisms are likely to be more and more frequent: bitcoin is doomed to evolve to cope with the exponential number of its users and transactions. Like the gold rush in the 19th century, the speculative waves around cryptocurrency could only be the beginning, eventful, of a long history ...

Discover ZEYO , our portal dedicated to cryptocurrencies. Follow the prices of the main stocks and find all the bitcoin news produced by Capital. You can also join our specialized Facebook discussion group by clicking on the banner below.

Post a Comment